Standards

Thought Leaders

Sustainability rankings don’t always identify sustainable companies

An increasing numbers of investors depend on ESG information from third parties for their investment decisions but are the rankings meaningless?

- COMMENTS 13

- LIKES 149

- VIEWS 160

Thought Leaders

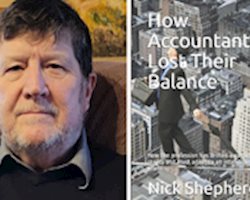

Imbalance: Accounting is not capturing the value of intangible assets

Accounting has an intangibles problem, says Nick Shepherd, author of How Accountants Lost Their Balance

- COMMENTS 13

- LIKES 149

- VIEWS 160

Management

The Canadian Securities Administrators publishes guidance for issuers on improving COVID-19 disclosure

The CSA has provided specific guidelines but there is no one-size-fits-all model, according to Ted Brown, Lindsay Cox, and Michael Akins of BD&P

- COMMENTS 13

- LIKES 149

- VIEWS 160

Thought Leaders

Nova Scotia first province to report Key Audit Matters in Auditor General report

KAM will provide Nova Scotians with context and transparency

- COMMENTS 13

- LIKES 149

- VIEWS 160

Thought Leaders

What is sustainability accounting? What does ESG mean? We have answers

Sprott Professor Leanne Keddie, CPA, CMA, provides an ESG primer

- COMMENTS 13

- LIKES 149

- VIEWS 160

Business

Annual reports should inform society — not only those with a financial interest

Climate accounting standards an example of societal impact, explains Financial Accounting Professor Alan Jagolinzer

- COMMENTS 13

- LIKES 149

- VIEWS 160

Profession

Canadian pension plan CEOs call for adoption of SASB, TCFD

Joint statement on leveraging standardized sustainability accounting standards

- COMMENTS 13

- LIKES 149

- VIEWS 160

Practice

Professional corporations and income for child support – Guidance from the BC Court Of Appeal

Chantal M. Cattermole of Clark Wilson LLP on a case involving competing income assessments prepared by two Canadian accountants

- COMMENTS 13

- LIKES 149

- VIEWS 160

Practice

Why Canadian accountants need a CEWS client engagement letter now more than ever

Accounting practitioners are under pressure during the current pandemic to meet their clients' needs. Clearline Consulting has COVID-19 practice-related resources to mitigate risk

- COMMENTS 13

- LIKES 149

- VIEWS 160

Thought Leaders

Bottom Line Profits: "It Ain't Necessarily So"*

Tax lawyer and accountant Vern Krishna looks at "the art of communicating financial information" through accounting

- COMMENTS 13

- LIKES 149

- VIEWS 160

Profession

Accounting Principles: Part I

Vern Krishna of TaxChambers LLP explains the language of the world of finance and taxation in part one of a series

- COMMENTS 13

- LIKES 149

- VIEWS 160

Profession

6 financial reporting and assurance considerations under COVID-19

Depending on the year-end of the organization, the financial reporting impact and the reporting considerations will be significantly different, says Bridget Noonan of Clearline Consulting

- COMMENTS 13

- LIKES 149

- VIEWS 160