Morneau tax talk ends. What will the Liberals do next?

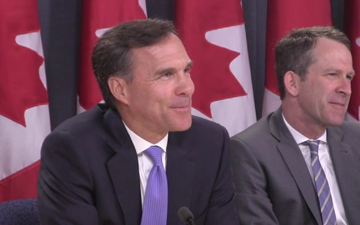

The 75-day consultation period is over. How will Finance Minister Bill Morneau change his tax proposals?

TORONTO, Oct. 6, 2017 – With Finance Minister Bill Morneau admitting that “changes are going to be required” to the Trudeau government’s contentious tax reform proposals, tax accountants and lawyers are wondering what steps the Liberals will take next to salvage their proposals.

“I don’t understand how Finance can absorb all the feedback they received and still come out with new draft legislation in two or three weeks,” says David Malach, a tax litigation lawyer with Aird & Berlis LLP in Toronto. “It’s very concerning that they could turn something around that quickly.”

Malach points out that a number of substantial submissions (including his own submission, which you can read here) came in at the very end of the 75-day consultation period. “How are they going to digest all those submissions and come out with something so it can be voted on before they break for recess in December?”

The government intends to clarify some of the legislation’s unintended consequences. “Maybe they should have drafted it correctly the first time,” says Malach, who says the “skilled people in finance” should have gone over the proposals with a fine-toothed comb.

“In addition to the dissatisfaction with the proposals there are serious technical problems with what they’ve drafted,” he says, calling the proposals “convoluted, complicated and not at the same level we’re used to seeing coming out of finance.”

Dennis Howlett, the executive director of Canadians for Tax Fairness, says the Liberals should have held a public hearing process on all tax expenditures and then introduce comprehensive reform. “There were no public hearings on this, so that didn’t allow for the public to be educated, or for the debate to generate consensus.”

He doesn’t believe the Liberals really had a communications plan for the rollout. “I don’t think they anticipated the kind of reaction they received. On balance, with a little tweaking, this would make the tax system more fair. But I agree with some of the critics who ask why the Liberals are going after small business when corporations are avoiding taxes by shifting profits to subsidiaries and tax havens.”

Malach stresses that he is not “political.” But the Liberals, he says, have backed themselves into a corner and cannot backtrack because “they will lose a ton of 99 per-centers. The 99 per-centers will start running against them. They shouldn’t have been talking, they should have just been listening.”

Predicting the Morneau changes

Howlett is concerned that any revisions to the draft legislation should not reduce the expected revenue but he believes some tweaks are warranted. “Things like ensuring the transfer of farms and small business to the next generation would be legitimate. We don’t see any justification for changing income sprinkling except where family members actually contribute to the family business.”

Howlett says his group is still debating its position on passive investments but believes “there could be some justification for capping, in order to provide a cushion for a business, which may be a legitimate issue, but using private corporations as a vehicle for passive investments doesn’t contribute to job creation or productivity growth.” He believes such a cap should not exceed $500,000.

Malach stresses that, in his view, tweaking a flawed process would be “inappropriate.” He wrote an article on the subject for the Toronto Star called “Suggestions for Morneau’s tax changes,” which listed six recommendations to “appease this anger, move forward in a sensible manner, protect the Canadian economy and put an end to the rhetoric surrounding the so-called ‘loopholes.’” Like Howlett, he sees other areas of the tax code that are more deserving of the government’s attention.

But he agrees that the Liberals can tweak the rules, depending on the voters that concern them the most. For example, “the tax on investment income — only if you have more than 50 grand. But if you say that, no one will have more than $50,000 of investment income. I will tell my clients, ‘Earn $49,000 of investment income in your company and the rest of it, I’ll figure out how you can earn it outside the company.’”

Like a lot of tax professionals, including Chartered Professional Accountants, watching taxation dominate the news cycle and Question Period has been a novelty for Malach. He has attended at least two vociferous public meetings with politicians. And he has spent tens of hours studying the proposals.

“It’s been intellectually challenging, I can tell you that. And sort of exciting.”

Colin Ellis is editor-in-chief of Canadian Accountant.

(0) Comments