Taxation

Thought Leaders

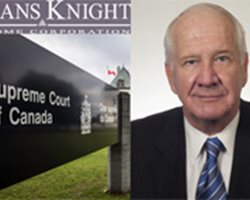

Deans Knight: The return of the GAAR

The Supreme Court of Canada's decision in Deans Knight is a breath of fresh air and strikes a more appropriate balance, says Allan Lanthier

- COMMENTS 13

- LIKES 149

- VIEWS 160

Profession

Sunday News Roundup 23.06.04: Hot economy, tax hypocrisy, and more Canadian accounting news

Wrapping up the odds and ends from the past week in Canadian accounting news

- COMMENTS 13

- LIKES 149

- VIEWS 160

Practice

Burden of proof for misrepresentation in tax reassessments is high — and rests with the CRA

In a recent Tax Court of Canada case, the Canada Revenue Agency's proof was flimsy, says Canadian accountant and tax lawyer David J Rotfleisch

- COMMENTS 13

- LIKES 149

- VIEWS 160

Thought Leaders

Taxing the wealthy to the hilt would make us all much better off

Western University professor Tom Malleson presents five reasons for levying high taxes on the very rich, from the environment to (reduced) social friction

- COMMENTS 13

- LIKES 149

- VIEWS 160

Profession

Sunday News Roundup 23.05.28: The Deans Knight Rises, Big Four soaps, and more Canadian accounting news

Wrapping up the odds and ends from the past week in Canadian accounting news

- COMMENTS 13

- LIKES 149

- VIEWS 160

Thought Leaders

The Revenue Rule In Tax Law

Vern Krishna of TaxChambers LLP on the history of international tax and trade law

- COMMENTS 13

- LIKES 149

- VIEWS 160

Practice

GST/HST tax fraud is a ‘special operation' at the Canada Revenue Agency

It involves fraudulent refund claims, fake invoicing, and GST/HST evasion through off-the-books cash sales, explains tax lawyer and accountant David J. Rotfleisch

- COMMENTS 13

- LIKES 149

- VIEWS 160

Practice

Why the Canada Revenue Agency tax workers strike was good for Canadian accountants

All sides will benefit from the tentative settlement and four years of labour peace. But technology investment is mitigating the impact of CRA strikes

- COMMENTS 13

- LIKES 149

- VIEWS 160

Practice

The Alternative Minimum Tax Goes Mainstream

Stephen Bowman and John (Jay) Winters of Bennett Jones present a capital gains case study on the impact to taxpayers of changes to the AMT regime

- COMMENTS 13

- LIKES 149

- VIEWS 160

Profession

Sunday News Roundup 23.04.09: CRA strike vote, carbon tax, software dealbook, and more Canadian accounting news

Wrapping up the odds and ends from the past week in Canadian accounting news

- COMMENTS 13

- LIKES 149

- VIEWS 160

Practice

How would a CRA strike impact Canadian accountants and tax preparers?

We clear up some of the misconceptions around a strike vote by Union of Taxation Employees at the Canada Revenue Agency during tax season

- COMMENTS 13

- LIKES 149

- VIEWS 160

Practice

Taxpayer’s management services not a personal endeavour

Amit Ummat of Ummat Tax Law on a successful appeal of a Tax Court decision involving a dispute over non-capital losses and the concept of a personal element

- COMMENTS 13

- LIKES 149

- VIEWS 160