Taxation

Practice

Case Commentary: Charlebois v. The King – How NOT to apply for GST/HST rebate for owner-built homes

The CRA can make assumptions that a home is not qualified for a rebate; it is the taxpayer's burden to refute the assumptions, explains David J Rotfleisch

- COMMENTS 13

- LIKES 149

- VIEWS 160

Practice

International remote work: Tax issues, Part II (Canadian companies)

In part two of a two-part series, George Gonzalez and Gillian Holthe of the University of Lethbridge review key tax issues for remote workers outside Canada

- COMMENTS 13

- LIKES 149

- VIEWS 160

Practice

Does your job require you to buy luxury goods? And, can you deduct those luxury goods on your taxes?

Canadian tax lawyer and accountant David J Rotfleisch deconstructs the case of Holt Renfre employee claiming luxury clothing expenses in Samotus v. The King

- COMMENTS 13

- LIKES 149

- VIEWS 160

Practice

Section 160 leads to derivative tax liability for 50-50 shareholders who receive dividends from a tax-debtor corporation

Canadian tax lawyer and accountant David J Rotfleisch comments on the section 160 tax trap in the Tax Court of Canada decision in McCague v The King, 2025

- COMMENTS 13

- LIKES 149

- VIEWS 160

Practice

Alberta: Nenshi says clawback of Assured Income for the Severely Handicapped is theft from disabled

Albertans receiving AISH are required to apply for CDB, but it will be counted as non-exempt income and be taken dollar-for-dollar from their AISH cheque

- COMMENTS 13

- LIKES 149

- VIEWS 160

Practice

International remote work: Tax issues, Part I (workers)

In part one of a two-part series, George Gonzalez and Gillian Holthe of the University of Lethbridge review key tax issues for remote workers outside Canada

- COMMENTS 13

- LIKES 149

- VIEWS 160

Business

Niagara council rejects bid for $40M taxpayer incentive to fund luxury homes

Niagara Regional Council decision to reject a maneuver to avoid defeat of $40 million developer incentive called a victory for taxpayers outside of Welland

- COMMENTS 13

- LIKES 149

- VIEWS 160

Thought Leaders

Staying the course toward sound public finances

The absence of a federal budget underscores the importance of returning to fiscal consistency, says Université de Sherbooke taxation professor Luc Godbout

- COMMENTS 13

- LIKES 149

- VIEWS 160

Practice

Case Commentary: The application of the General Anti-Avoidance Rule on capital dividends

Canadian tax lawyer and accountant David J Rotfleisch looks at the impact the new GAAR may have had on the Magren Holdings case had the rule been in effect

- COMMENTS 13

- LIKES 149

- VIEWS 160

Partner Posts

Navigating 2025 tax changes: Expert insights from CPA Ontario's expanded Tax Immersion Program

CPA Ontario's Tax Immersion Program equips chartered professional accountants with the skills needed to thrive in the evolving Canadian and US tax landscape

- COMMENTS 13

- LIKES 149

- VIEWS 160

Partner Posts

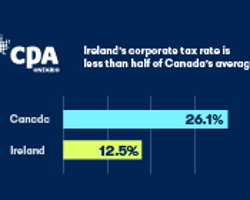

What can Canada learn from Ireland’s corporate tax approach?

Ireland shows that clear rules, competitive tax rates, and simplicity can help drive economic growth

- COMMENTS 13

- LIKES 149

- VIEWS 160

Practice

What expenses can owners deduct from rental properties that produce no income?

In Blecha v The King, the Canada Revenue Agency disputed whether a taxpayer was really renting residential property, explains tax lawyer David J Rotfleisch

- COMMENTS 13

- LIKES 149

- VIEWS 160