Streamlining accounting workflows and boosting efficiency with Loop

Joining Loop's accounting partnership program empowers accountants to enhance their practice, drive success, and deliver exceptional value to clients

Introduction

In today's fast-paced business environment, accountants and CPA firms need to leverage technology to refine their workflows, improve accuracy, and deliver better services to their clients. Loop, a comprehensive banking and spend management platform, offers a range of features and benefits that can greatly enhance accounting practices. In this article, we will explore how Loop can help Canadian accounting professionals to streamline their operations and save money for their clients.

Refining Workflows at Your Accounting Practice

Accounting practices can benefit from Loop's all-in-one software, which combines corporate cards, bill payments, and expense management in a centralized platform. By reducing the number of software providers and automating workflows, Loop saves valuable time and simplifies processes for both accountants and clients. Accessing multiple clients accounts within a single dashboard and setting up approval processes streamlines accounts payable procedures, making them quicker and hassle-free.

Faster and More Accurate Reconciliation

Loop's integration with leading accounting software providers like QuickBooks and Xero facilitates seamless accounting automation. By syncing first-party transaction and receipt data, Loop eliminates data quality issues commonly associated with client credit card expenses. This eliminates the need for manual data clean-up, saving accountants significant time and effort. With Loop, accountants can focus more on analysis and value-added services rather than administrative tasks.

|

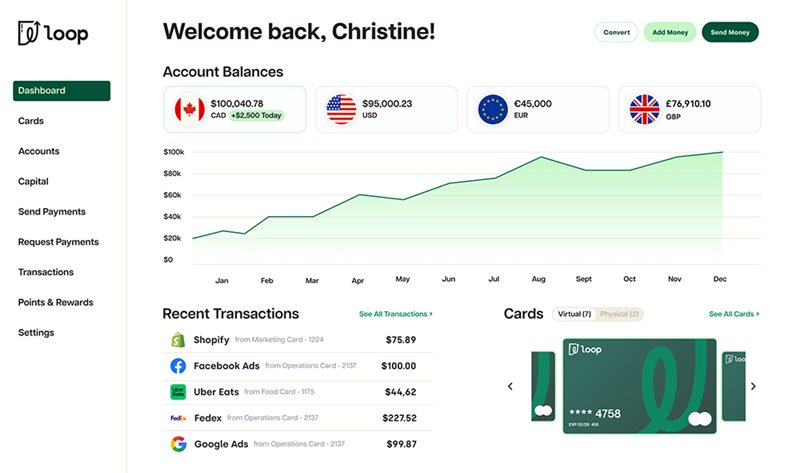

Loop centralizes day-to-day global banking, invoicing, international payments and expense management into one dashboard for all your clients. (CLICK IMAGE TO ENLARGE.) |

Gives Clients the Tools they Need to Improve Cash Flow

Loop is providing solutions that offer data and insights on spend, enabling better financial management. With 55-day repayment terms on credit cards and competitive capital products like purchase order, and invoice financing, businesses have the flexibility and liquidity they need to manage their cash flow effectively. Loop's comprehensive approach helps businesses gain clarity around their expenses, optimize spending, and access additional capital when needed, allowing businesses to improve their financial performance.

Saving Money for Clients

Loop's global banking capabilities and market-leading conversion rates enable significant cost savings for clients. By offering local bank accounts in multiple currencies, Loop minimizes foreign exchange conversion fees. Accountants can advise clients to adopt Loop, helping them save substantial amounts on FX fees, which can often amount to tens of thousands of dollars per year. Loop's commitment to saving money for clients aligns with the goals of Canadian accountants to provide value-added services and generate long-term client satisfaction.

Partner with Loop to unlock value

Loop's accounting partnership program offers numerous advantages to accountants and CPA firms. Partners gain access to Loop's Partner rewards program, receiving client insights, referral payouts, and co-marketing opportunities. Our Partner Directory allows partners to market their services to existing Loop customers, generating leads for their firms.

Additionally, dedicated partner support ensures personalized assistance and guidance. Joining Loop's accounting partnership program empowers accountants to enhance their practice, drive success, and deliver exceptional value to clients.

Conclusion

Take your accounting practices to new heights with Loop. Simplify workflows, enhance accuracy, and save money for your clients. Check out Loop today and unlock the potential of your accounting business. For questions about the partnership program, please reach out to Loop here.

Sebastian Nordstrom is Head of Partnerships at Loop Financial.

(0) Comments