How accountants are ushering Canada’s SMBs onto the path to recovery

Three ways to get your clients on the road to Canada’s post-pandemic rebound

|

Faye Pang is Canada Country Manager at Xero. |

BY ALL ACCOUNTS, Canada’s economy looks set for a major rebound. The Conference Board of Canada, for one, recently predicted that the economy will expand 5.8% this year and 4% in 2022, compared to 1.8% growth in 2020. This anticipated growth is in part due to the ongoing rollout of COVID-19 vaccines, which will inevitably lead to a gradual reopening of the economy, potential uptick in household spending, and overall increased confidence.

Canada’s small and medium-sized businesses will benefit from all of the above, but they will also be driving it. SMBs make up 98% of all employer businesses in the country — and while they are the engines of our economy, they can’t do it without solid, expert help from the country’s accountants and trusted financial advisers.

Financial literacy

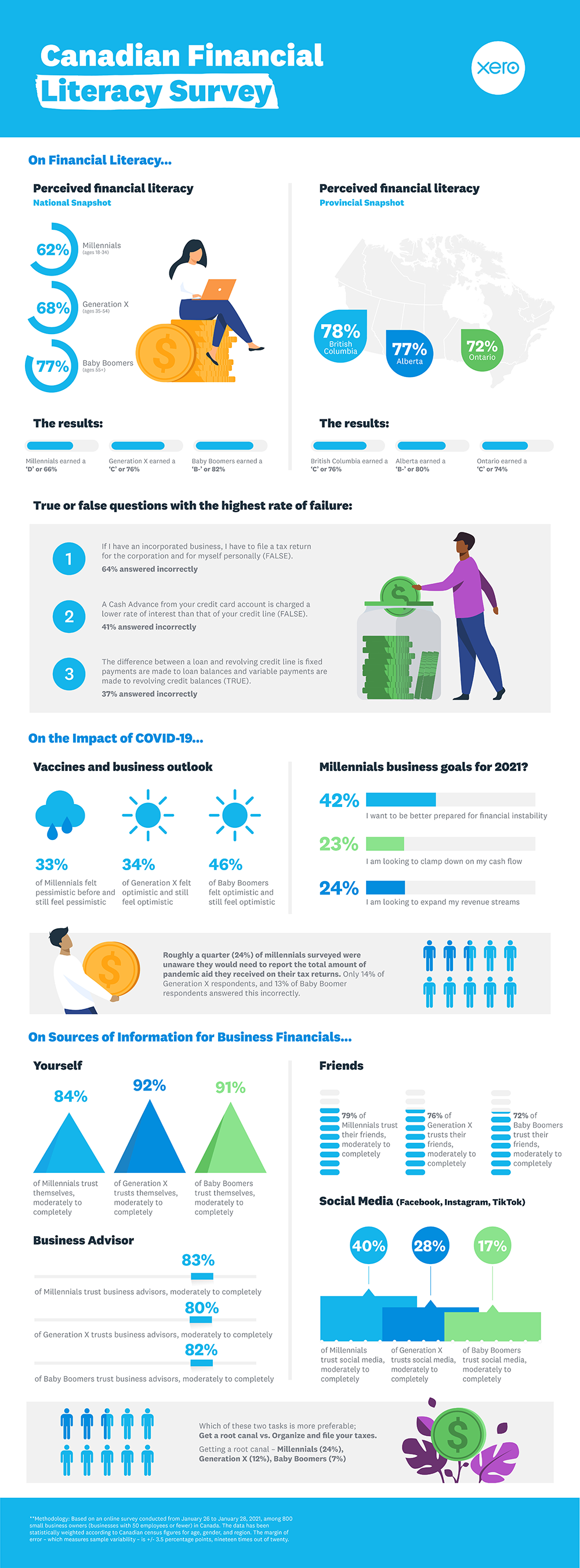

In our recent survey of 800 Canadian small business owners, we found that millennial small business owners in particular (those aged 18 to 34) tend to overestimate their financial literacy. The majority of millennials surveyed (62%) consider themselves financially literate, but the demographic as a whole received a ‘D’ letter grade after answering a series of true or false financial literacy questions. That is a major disconnect between perception and reality.

|

CLICK ON THE INFOGRAPHIC TO ENLARGE. |

The good news for business owners is that they have professionals whose expertise they can call on for three key areas of accounting services — compliance, performance, and strategy. There’s even better news for accounting professionals like you. New technologies, including cloud-based accounting software platforms like Xero, are making it easier than ever to offer this full range of services.

Here are three ways that accountants can help put small businesses — and, by extension, Canada’s economy — on the path to recovery:

Compliance

Few business owners are thrilled at the thought of filling out and filing all the required legal and compliance documents. It’s a lot of work, and it only gets more laborious — not to mention complex — as a business grows. That’s where you come in. You have studied tax legislation so your small business clients don’t have to. Use that knowledge to their advantage by helping them stay up to date on the latest tax laws.

Clients will feel secure relying on you to prepare their annual financial statements, maintain statutory records, and keep accurate documentation of their employees’ payments. They will also be happy that you’re able to use your financial and tax knowledge to identify ways for them to save money, free up cash flow, and finance expansion. You might even be able to convince them that compliance can be thrilling after all.

Compliance is only scratching the surface, however. Where utility to your clients is concerned, the real value lies in advisory services.

Performance advisory

In the day-to-day grind of running a business, SMBs, without the guiding hand of a trusted adviser, can find themselves losing track of important financial responsibilities, such as invoicing or cash flow management.

A savvy accountant can play a crucial role in getting things back on track, and the latest technology can help by giving you a complete snapshot of vital financial data in real time, using a single ledger.

In short, accounting practices that operate in a performance advisory role use these reporting capabilities to analyze the health of the businesses they serve.

Strategic advisory

When you take on a strategic advisory role, providing virtual CFO services, you’ll be offering clients more than just mere data. They’ll be relying on you for your financial expertise. They will, of course, be in charge of steering their own ship, but they will turn to you for your skill at not just analyzing performance, but charting different courses of action.

It’s a visionary role, much like acting as a virtual CFO, and serves an educational purpose as well — your value will be in offering creative solutions to your clients and communicating those options in a way that makes them feel empowered to make the best decisions for their business.

The ultimate goal, of course, is for your accounting practice to focus on the financials so your business clients can focus on what they do best. In other words, getting their business, and Canada’s economy as a whole, on the road to a post-pandemic rebound. The only question is: Will you be prepared when the rebound comes?

Faye Pang is the Canada Country Manager at Xero. Images courtesy Xero.

(0) Comments