Why accounting and finance professionals are choosing Float corporate cards

Float cards and Float spend management software simplify business spending

Taking on the world of traditional corporate cards and expense management, Float is the first Canadian company to pair a high-limit corporate card with accounting automations and spend controls in its intuitive spend management platform.

Imagine: it’s month end, and suddenly, you’re faced with a mountain of expense reports to review and approve. As the head of your company’s accounting and finance functions, you know you’re in for a lot of chasing people down for receipts, reviewing expenses, and reconciling the books, often having to individually review, code, and assign expenses.

Or, you have just discovered that one of your few corporate cards has been compromised, affecting your software subscriptions and even your ad spend.

Perhaps you or your firm’s clients are like Float co-founders Rob Khazzam, Griffin Keglevich, and Ruslan Nikolaev, who were carrying thousands of dollars of corporate expenses on their personal credit cards, and scrambling to find the receipts for these charges; often waiting as many as 60 to 90 days to be reimbursed.

Those are just a few of the many scenarios that prompted the co-founders to launch Float.

What is Float?

Toronto-based Float is Canada’s first smart corporate card and spend management software built to simplify business spending for companies and teams. It offers the ability to manage, control, automate, and scale corporate spending — all within a single platform.

To start, the application process for traditional business credit cards is often tedious and lengthy, and typically constrains companies to issuing only a few cards to select individuals, and to spending limits that may also limit company growth.

With Float, companies are able to be approved with higher limits than a traditional corporate card would offer, because the card limits are linked to the company’s bank balances. And, with a simple five-minute application, you can be approved within days, not weeks, so you can start spending almost immediately. Float corporate cards can also be used anywhere VISA is accepted.

Why growing companies from Properly and Nerva to Coinberry use Float

According to Rhianna Brancato, CPA, CA, vice-president of finance at real estate tech company Properly, this scalability was their initial reason for considering Float. “As a startup, our credit card limit was low and our spend policies were essentially non-existent. What we had wasn’t scaleable and Float turned it all around.”

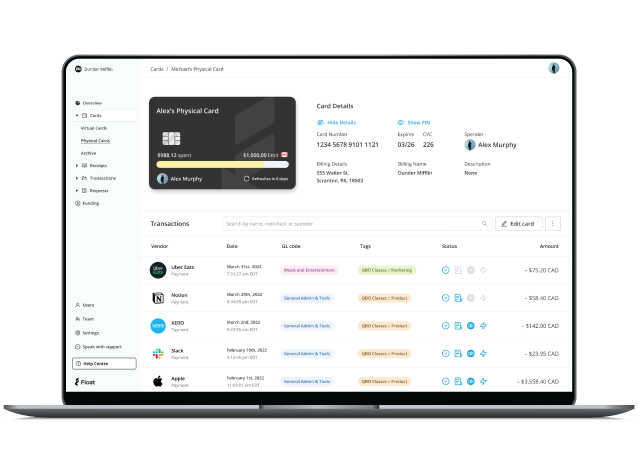

With Float, companies are able to issue physical or virtual cards to any individuals on their teams. With this type of flexibility, team members will no longer need to use their personal credit cards for day-to-day expenses (always a risk when it comes to trying to control corporate spending). Not only that, each vendor expense can be managed by assigning GL codes, spend limits, and more — right on the platform.

There are also no limits to the number of virtual cards that can be issued — clients have the flexibility to issue cards to vendors and internal teams, controlling spend limits and the rules around processing expenses. This ensures vendors get paid, no matter if the person who holds the traditional corporate card is out of the office, and eliminates the possibility of service disruptions while needing to wait for a traditional credit card transaction to be approved.

This feature was incredibly useful to many clients during the pandemic. As teams moved to asynchronous working hours, and companies were scrambling to keep up with every day business expenses, reimbursing employees for home office setup expenses, mental health supports, and benefits, being able to issue virtual credit cards with pre-defined spending limits was incredibly helpful.

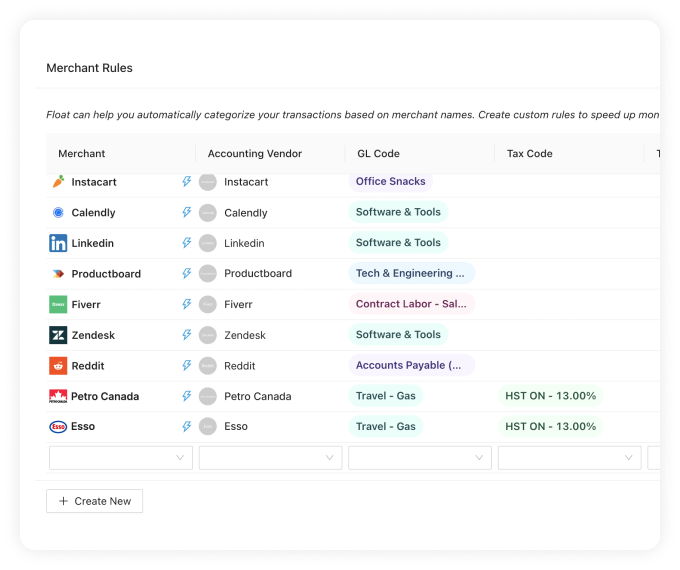

Organizations typically appreciate that beyond spend controls, Float also eliminated the dreaded monthly expense reporting frenzy. With end-to-end approval on spending, the ability to place limits on each virtual corporate card as needed, and automated receipt collection that not only automatically reminds individuals to submit their receipts, it also allows teams to lock the cards of individuals who haven’t done so. The best part? Receipts are automatically matched and coded based on defined rules.

This was important to Jerry Lin, vice-president of finance at Coinberry, a Canadian digital asset trading platform, as they considered making a move from AMEX to Float. “Using Float, our bookkeeper can track expenses throughout the month instead of waiting for employees to submit their receipts at the last minute. By the time month-end comes along, 80% of the work is already done.”

Not only that, as companies grow, that seamless management grows — that single spend management platform continues to work hard — providing you with end-to-end oversight, virtual corporate card management, and the ability to set your own chains of approval and rules around spending.

According to Heather Brunt, controller at Nerva Energy, the platform’s ability to do all of the above is huge. “We have hundreds and hundreds of transactions a month, which is why this platform is so huge for us. To go through that many receipts would be impossible,” she says.

Companies of any size can benefit from Float’s offering, but it’s often mid-sized businesses — between 50 and 300 employees — that could see the best outcomes, especially since those long approval times, and relatively low credit extensions when applying for traditional business credit cards exist. Khazzam says, “We help address that issue by making Float accessible to any small- or medium-sized business that’s incorporated in Canada. They can get access to corporate cards after going through a relatively short compliance process that takes a couple of days. They’re going to get out-of-the-box cards that have very high limits — basically as high as their cash balance can sustain — and very high transaction limits.”

Whether you’re a Canadian accountant managing your clients’ finances, or you’re the head of your company’s accounting and finance department, visit floatcard.com to learn more or book a demonstration.

By Amrita Gurney. All images provided courtesy of Float.

(0) Comments