Practice

Profession

CRA further circumscribes trust 21-year planning strategies involving non-resident beneficiaries

The CRA's stated positions will result in a chill on tax practitioners' advice to their clients, says Stephen Sweeney of Miller Thomson

- COMMENTS 13

- LIKES 149

- VIEWS 160

Profession

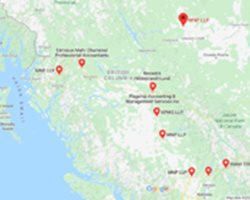

Changing of the guard in northern BC accounting

As Deloitte and PwC leave, MNP expands its footprint through mergers

- COMMENTS 13

- LIKES 149

- VIEWS 160

Practice

Scott v The Queen: The importance of evidence

How two brothers came under the scrutiny of the Tax Court of Canada

- COMMENTS 13

- LIKES 149

- VIEWS 160

Practice

3 things to consider about the new CSRS 4200 accounting standard

The new CSRS 4200 is the most impactful on firms since tax reform in 2017, says Bridget Noonan. What should your firm’s first steps be?

- COMMENTS 13

- LIKES 149

- VIEWS 160

Business

Survey: Risky financial behaviours keeping Canadians in debt

Insolvency practice of accounting firm MNP probes Canadians' money mistakes

- COMMENTS 13

- LIKES 149

- VIEWS 160

Practice

Donor Beware: The pitfalls of participating in a donation tax shelter

The Tax Court of Canada case Abreo v. The Queen

- COMMENTS 13

- LIKES 149

- VIEWS 160

Profession

Canadian accountants sign global climate change statement

CPA Canada aligns with global accounting bodies to address climate change

- COMMENTS 13

- LIKES 149

- VIEWS 160

Partner Posts

How to persuade your accounting clients to adopt new technologies

Use the right approach and your clients will be scanning their own receipts, says Jennie Moore of Moore Details Inc.

- COMMENTS 13

- LIKES 149

- VIEWS 160

Practice

What risk does coronavirus pose to Canadian auditors?

Securities regulator issues statement following UK, US audit watchdogs

- COMMENTS 13

- LIKES 149

- VIEWS 160

Practice

The case of Muir v The Queen

Tax Court of Canada allows appeal over a section 160 assessment by the CRA

- COMMENTS 13

- LIKES 149

- VIEWS 160

Practice

A sad story about Mr. X. from country Y

Canadians are deemed guilty in an unfair tax system, says Tax Lawyer Dale Barrett

- COMMENTS 13

- LIKES 149

- VIEWS 160

Practice

Hamad v. The Queen

Canadian tax lawyer and accountant David Rotfleisch on due diligence In director liability for taxes

- COMMENTS 13

- LIKES 149

- VIEWS 160