It’s time to set the bar higher for year-end and tax

Public Accountant Helina Patience on setting your practice up for success

When I was earning my public accounting licence for my firm a few years ago, one of my course instructors tried to set our expectations. “Plan to not make a profit on year-ends in your first year,” he told us.

I was gobsmacked. While I wasn’t yet offering tax services, I had been running a public practice firm for several years and my gut told me that this was simply bad advice. It was setting the bar too low.

Yes, time is money, and year-end can be time consuming. But I also knew then (and definitely know now) that with the right tools and the right mentality, there is no reason why year-ends can’t be smoother and more profitable.

Better workflow now, better year ahead

To set our clients up for future success, we need to set ourselves up for it first. In my case, to grow our financial management and fractional CFO business, we knew we needed a seamless, reliable solution for bookkeeping data, Workpapers and tax filing, all in one place. At Entreflow, we have been using QuickBooks Online Accountant for three tax years now — and we’ve been proving that instructor wrong.

For me, it all comes down to data quality. The cleaner and more up to date the data, the more efficient the year-end will be. Without that, you really can kiss profitability goodbye. If you set aside a certain number of hours for a file, you should be able to get it done in that time — but that’s not possible if you have to keep going back and forth to check journal entries and bank reconciliations.

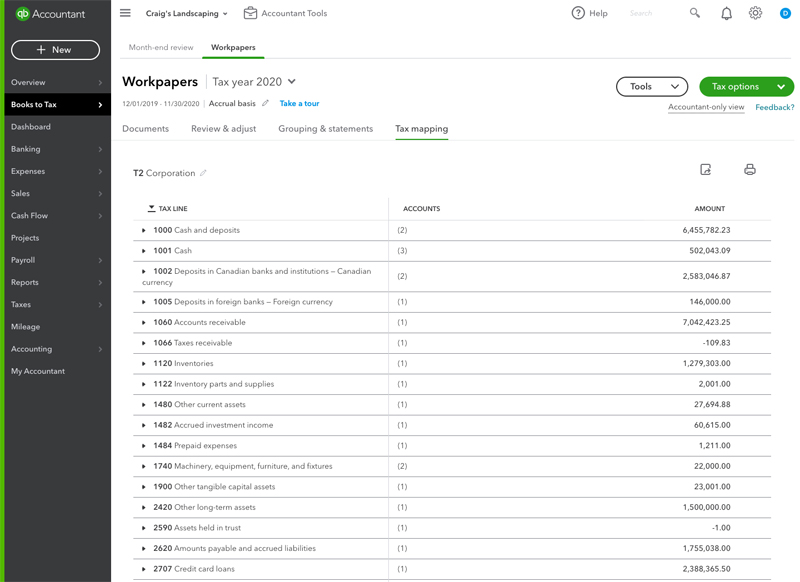

With a cloud-based solution like QuickBooks Online Accountant, you can count on bookkeeping information being up to date and your workflow being within one tool, instead of spending time importing and exporting data. Having Workpapers right within the workflow means our team doesn’t have to contend with other apps. We also have the GIFI data we need and can make multiple adjustments at once. In other words, we’re spending our time on the accounting, not on manually entering data and figuring out software quirks.

|

Workpapers is available in QuickBooks Online Accountant edition and is accessible via the Accountant dashboard. (Workpapers screenshot, courtesy QuickBooks.) |

Good quality data is key, and so is having it on time. To better plan for what’s ahead, clients need to know where they’ve been. Getting data that’s six months old isn’t helpful when they need to make decisions now.

Of course, we want to avoid unnecessary delays that cause our clients fines at tax time. However, it’s also about our relevance as advisors. As accountants, we play a fundamental role in setting up our clients for future success, and a more efficient year-end lets us do that more effectively. When we have real-time bookkeeping data, we can spot anomalies faster and address them sooner.

In my business, for example, we focus on entrepreneurs and helping start-ups drive their businesses forward. These are hungry new businesses on the hunt for investments and capital to grow. Having incomplete data or books that aren’t up to date is simply not an option. With real-time data, we can make sure our clients don’t miss out on opportunities to raise capital or secure loans.

Collaborating across kilometers

A cloud-based books-to-tax workflow allows you to work from anywhere, which is especially important in a year as unpredictable as this last one. Our practice started fully remote before moving to a hybrid model, so for our team of about 25 people — based in various cities — the transition to working from home full time was relatively easy.

However, I know that unfortunately wasn’t the case for firms who are still using desktop solutions. It’s crucial that firm members can share data securely among themselves as they work. Along with making that secure collaboration more challenging and time consuming, desktop solutions also leave more room for error in the data itself. From a liability and CRA compliance perspective, there’s simply too much at stake to get it wrong, for you and for your clients.

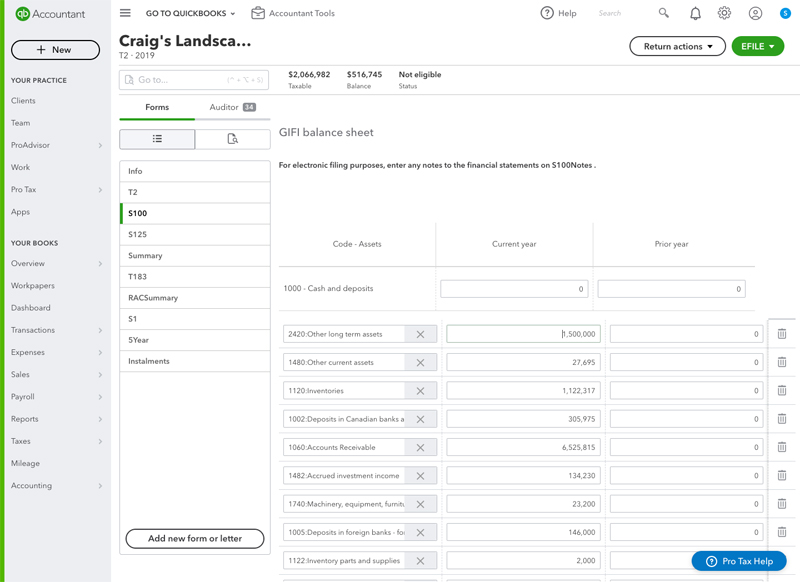

For our practice, the ability to connect and collaborate remotely, especially on year-end and tax files, has been crucial. With Pro Tax integrated into QuickBooks Online Accountant, the days of printing out paperwork for a reviewer are gone. Everything you need for an efficient year-end workflow is remote and all in one place.

|

With Pro Tax integrated into QuickBooks Online Accountant, the days of printing out paperwork for a reviewer are gone. (Pro Tax T2 General screenshot, courtesy QuickBooks.) |

COVID-19 aside, life often gets disrupted and the more flexibility we can offer our clients, so they don’t miss a financial beat, the better. I also firmly believe that the future of work is going to demand greater flexibility and collaboration in real time, even when your team — and clients — can’t be in the same place at the same time. You can’t meet those new expectations without reliable cloud-based tools.

I know many of us are reflecting on a tough year behind us and uncertain about what lies ahead for the economy and our businesses. But I also know that we can all look forward to better things ahead, for our firms and for our clients — and we shouldn’t be afraid to set our expectations high.

Helina Patience, CPA, CMA is CEO of Entreflow Consulting Group.

(0) Comments